Table of Contents

The steady growth of B2B eCommerce offers suppliers a pivotal chance to not only broaden their market share but also secure a competitive edge. A recent TradeCentric study, in partnership with Digital Commerce 360, surveyed 120+ U.S. B2B manufacturers and distributors to map their maturity to meeting their customers’ evolving eCommerce buying requirements.

While nearly 90% of respondents experienced solid eCommerce growth in the past year,B2B buyers are becoming increasingly digitally savvy, and more are asking for sophisticated integration capabilities as they adopt and standardize on eProcurement solutions as their preferred buying methodology. While some suppliers have been investing in eCommerce and eProcurement integration capabilities for years, many companies are still challenged to the changing demands of their most important customers. The consequences of falling behind in this leg of the digital transformation race are severe lower customer loyalty, revenue impacts, competitor encroachment, and more.

Understanding the state of B2B eCommerce

The primary goal of the survey was to gain a better understanding of where B2B suppliers are on their eCommerce journey, as well as how they are interacting with their customers digitally. Here are four main takeaways from the survey data:

1. B2B eCommerce continues to grow

As evident from reports and data from various other sources, B2B eCommerce continues to experience consistent growth, chipping away at entrenched and costly manual ordering channels. Nonetheless, the rates of growth differ significantly among suppliers. While nearly 20% of our survey respondents enjoyed 25%+ growth in their commerce top lines during the last year, another quarter of respondents experienced growth of 10% or less.

Our survey data shows that the extent of growth varies based on the level of digital investment and the maturity (or absence thereof) of eCommerce commerce capabilities across U.S. manufacturers and distributors.

2. eCommerce maturity varies

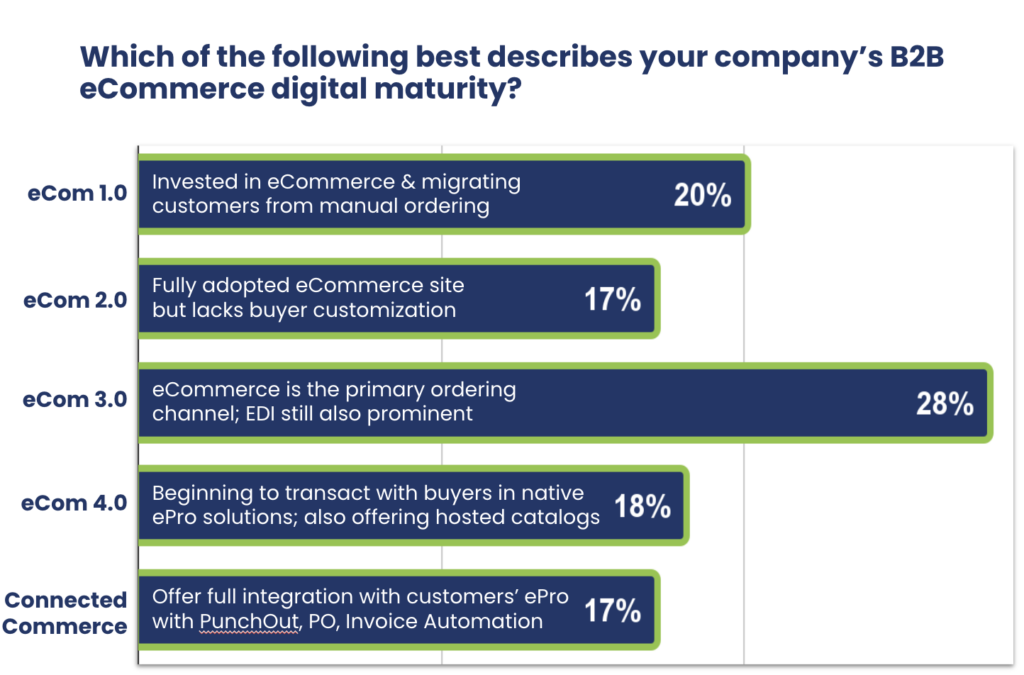

Our survey delineated where B2B suppliers slot into the eCommerce maturity curve. The survey categorized “maturity” into 5 different stages, described below, and asked respondents to self-select their maturity based on how their commerce experiences are operating. Here’s a breakdown of their responses:

Suppliers are scattered across the eCommerce maturity spectrum. While some are making strides, others still have milestones to achieve for a truly customer-centric eCommerce experience. And this is despite significant investments by many over the past 5+ years. Clearly as a community we have work to get done.

3. Demand for eProcurement integrations is rising – but only top performers are responding to customer requirements

61% of supplier respondents reported that almost a quarter of their customers (or more) are actively requesting that they connect their eCommerce storefronts with customers’ eProcurement solutions. This points to a significant gap in changing buyer behavior that’s not being met by suppliers. While there’s clearly demand from customers, only 35% of supplier respondents in our survey stated that they are actively investing in supporting the eProcurement purchasing channel.

In our humble opinion, as more customers adopt and rely on eProcurement solutions for purchasing centralization, suppliers must adapt to remain competitive.

4. Suppliers need insights from eProcurement

For those embracing eProcurement as a sales channel, data is key. Most suppliers want real-time visibility into transactions (63%) and insights into purchasing habits (61%). Understanding cart abandonment in this space is also crucial.

Insight into transaction data helps suppliers make more informed, data-driven decisions on how to adapt their digital sales channels. This will be key as eCommerce gains a higher percentage of wallet share for corporate spend.

Download the full report

The comprehensive report, packed with more insights, is available now. Unlock your copy to learn how your business stacks up to peers and the steps you can take to advance your eCommerce maturity to drive more profitable digital revenue gains.