Table of Contents

Invoice reconciliation is a key function in B2B transactions that ensures accuracy and consistency between what a buyer has ordered and what they have been billed for. It is industry best practice – and for publicly traded companies, a regulatory best-practice governed under the Sarbanes-Oxley Act – to complete invoice reconciliation before processing payment.

While important, this process has historically been very inefficient. Many companies still rely on their accounts payable (AP) teams to manually review hundreds of paper POs and invoices line-by-line. Further, human intervention and manual document sharing leads to increased error rates and processing delays.

Leading companies are increasingly leveraging B2B connected commerce solutions such as Purchase Order (PO) Automation, Invoice Automation and Advanced Shipping Notice (ASN) to streamline and accelerate invoice reconciliation via automated 3-way matching.

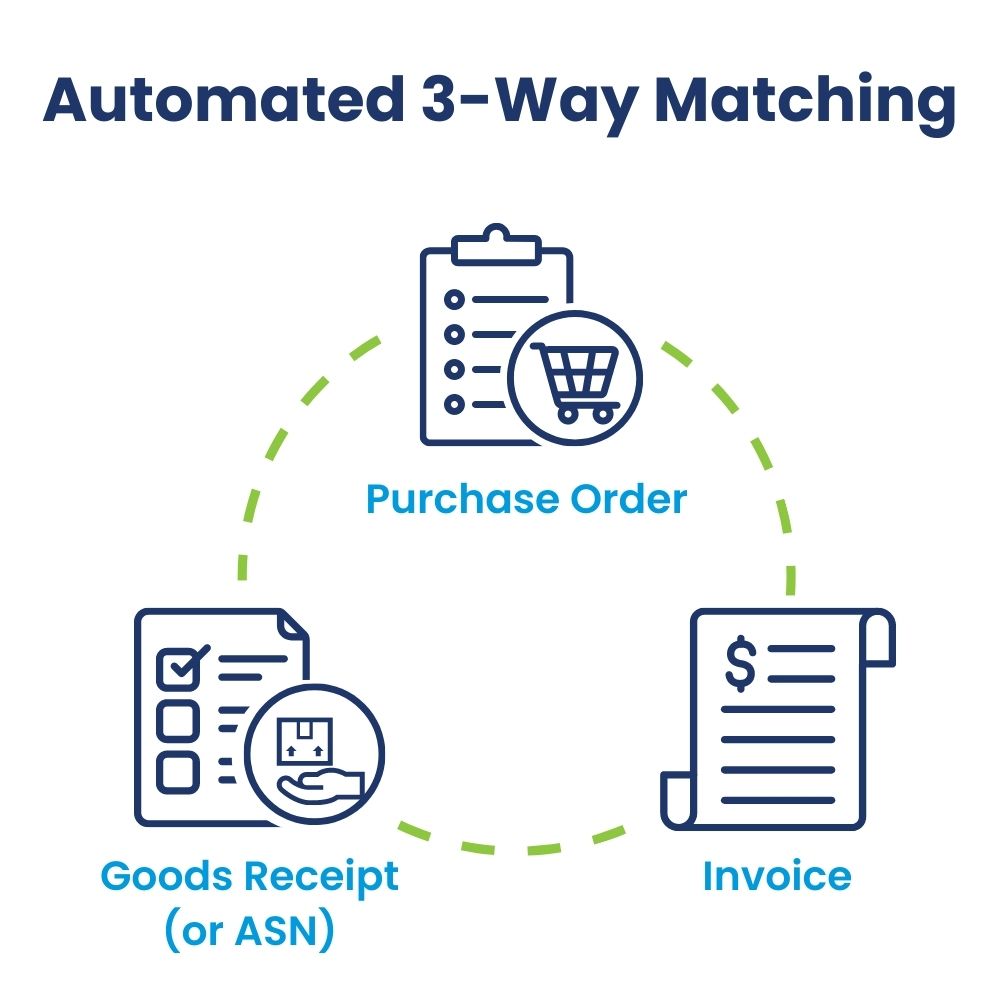

What is 3-Way Matching and How Does It Work?

In short, 3-way matching is when a company’s AP department cross-references the PO and corresponding invoice with a goods receipt. This process assists AP teams by comparing quantities purchased, invoiced and received to avoid overpayment as well as prevent fraud by weeding out fake invoices.

The process is as follows:

- After a buyer submits a purchase order, the supplier provides an invoice for the items ordered when they are shipped

- Once the order has been delivered, the requestor (desktop receiving) or loading dock (central receiving) enters the goods receipt information to confirm the goods have been received

- When it is time to complete invoice reconciliation for payment, AP reviews items such as item quantity and cost on the PO, then matches it to the invoice and goods receipt to ensure consistency

- If there are any inconsistencies beyond match exception rules, AP must manually review and resolve any discrepancies

- If discrepancies cannot be resolved payments may be put on hold

Common Challenges with Manual Invoice Reconciliation

Without automated 3-way matching, companies must manually input and review POs, invoices and goods receipts to complete invoice reconciliation. Common challenges for this process include:

- Tedious and Time-Consuming Review: POs and invoices must be reviewed line-by-line to ensure there are no discrepancies, plus documents are often delivered to inboxes in PDF form

- Manual and Labor-Intensive Tasks: Buyers and suppliers must dedicate AP resources to manually review and send documents back and forth

- Longer Reconciliation Process: Inefficient reconciliation processes directly translate to wasted dollars, and errors and processing delays can be costly

But before the manual review process can even begin, AP often must chase down the required documents to complete a 3-way match. While the PO and invoice are generally easy to track down, the goods receipt (a key component of the 3-way match) is not. Often, AP is waiting for the goods receipt to be submitted in a timely manner – and in some cases, it’s not submitted at all. Without this document, AP cannot complete the invoice reconciliation process and instead must spend time and resources sourcing the required information.

B2B Connected Commerce Supports More Efficient Invoice Reconciliation

Connected commerce automates invoice reconciliation by ensuring the data (address, bill to info, pricing, line items, etc.) transferred between systems is in sync and clean. PO Automation, Invoice Automation and ASN facilitate data transformation that translates documents into the correct fields and protocols so they can be consumed by buyer and supplier systems.

Furthermore, if an invoice gets rejected, an alert will be sent to the supplier so the issue can be quickly resolved. In most cases, issues are flagged before documents even reach the buyer, and problems can be resolved in a matter of minutes rather than weeks.

Streamlined and automated invoice reconciliation benefits buyers and suppliers alike. Not only does the process move faster with fewer errors and processing delays, but it also requires less AP resources. As a result, buyers can reconcile invoices more quickly, meaning suppliers can get their payment faster.

Benefits for a Buyer:

- Reduced invoice processing time frees up AP to focus on other key aspects of the business

- Timely payment avoids late fees and credit holds

- Accelerates reconciliation so payment is issued quicker, which improves relationships with key suppliers to earn better terms and prices

Benefits for a Supplier:

- Speeds up the reconciliation process to accelerate payment

- Improves relationships with key buyers

- Positions you as a preferred supplier by enabling easier and quicker invoice reconciliation for customers

- Avoids on-hold payments due to inability to complete 3-way reconciliation

A unique benefit of ASN is that this document can be used as a proxy for the goods receipt. Rather than tracking down the goods receipt, which often is either not submitted, submitted late, or sitting in an inbox, AP can leverage the ASN document to get the information they need and complete the 3-way match.

In an increasingly digital B2B commerce landscape, companies continue to seek ways to integrate and automate key aspects of the transaction process. The result is improved operational efficiency and accelerated business growth for buyers and suppliers alike.